A fixed deposit is one of the oldest and most trusted ways to save and grow money securely. It works on a simple principle: you deposit a certain amount with the bank for a fixed period, and in return, the bank pays you interest at a predetermined rate. The returns are guaranteed, and your principal remains safe. This makes FDs especially appealing for conservative investors who value stability over market volatility.

Fixed deposits are often compared to mutual funds or stocks, but the key difference lies in their predictability. While market investments depend on performance and carry risks, FDs assure a specific return. With banks now offering higher interest rates due to changing market dynamics, 2025 appears to be an attractive year for those considering fixed deposits.

IndusInd FD Overview

IndusInd Bank, known for its strong retail banking presence and innovative financial products, continues to attract depositors with its competitive FD rates. In 2025, the bank is offering interest rates of up to 8.25%, which makes it one of the most rewarding options in the private banking sector.

The rates vary depending on the tenure and type of depositor. Regular customers, senior citizens, and special tenures have slightly different slabs. For senior citizens, the rates can even cross 8.25%, offering additional incentives to long-term savers. The flexibility in choosing tenures from as short as 7 days to as long as 10 years makes IndusInd Bank’s FDs suitable for a wide range of financial goals.

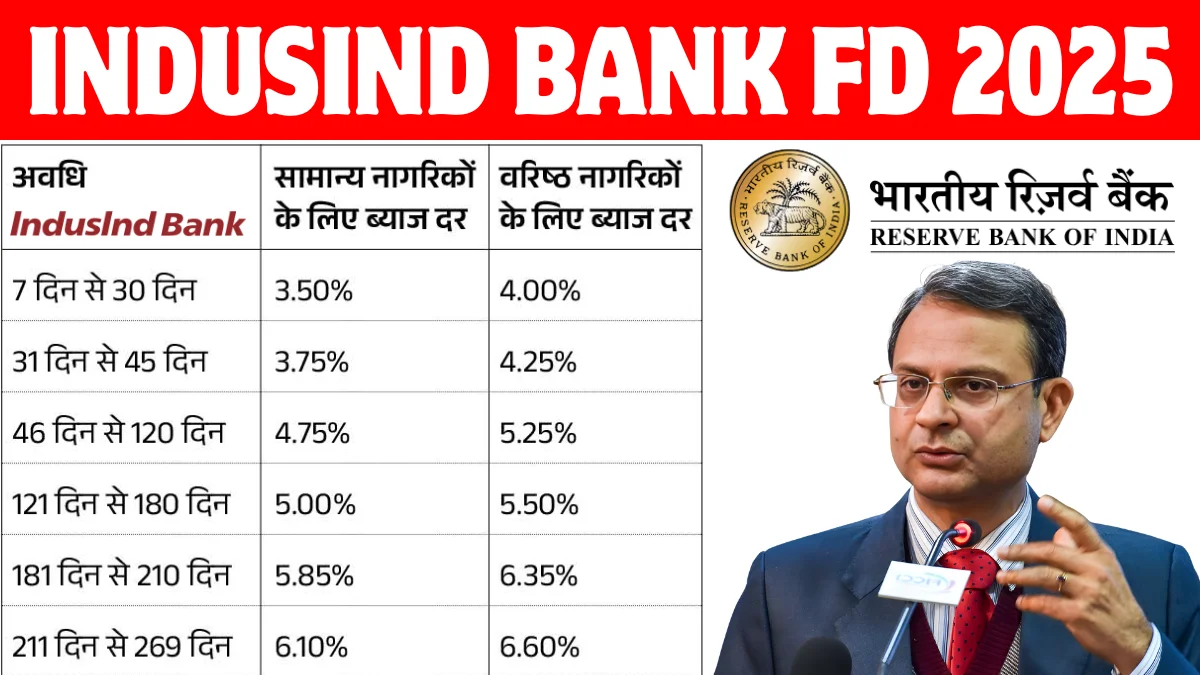

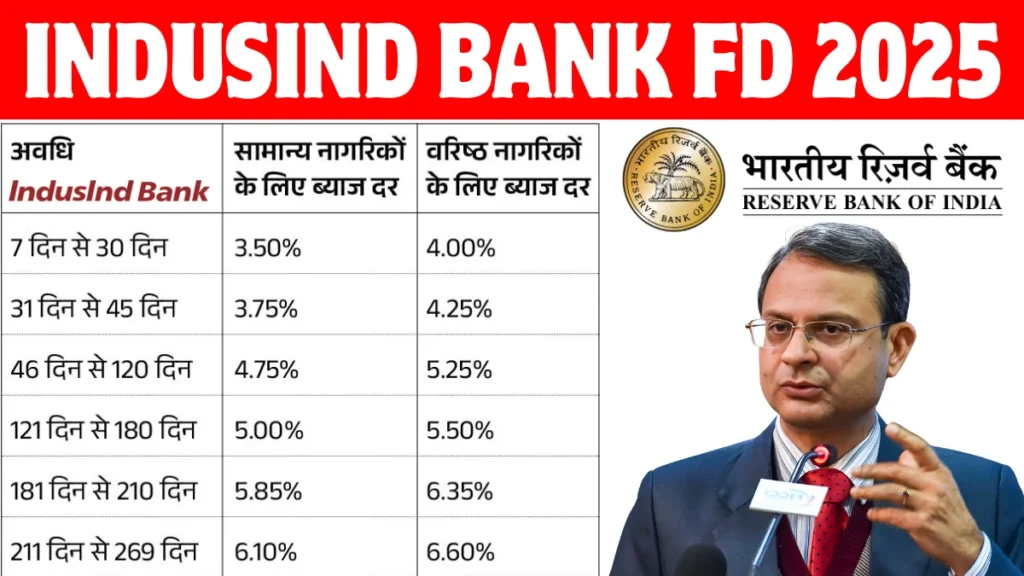

Interest Rate Structure

The interest rate structure at IndusInd Bank is carefully designed to benefit both short-term and long-term investors. Generally, the rates increase with the tenure, as the bank rewards customers for keeping funds locked in for longer durations. For instance, short-term FDs of under six months may offer moderate returns, while deposits ranging between one and three years often fetch the highest interest rates.

The 8.25% figure is particularly attractive for tenures around 500 to 700 days, depending on periodic revisions. These rates are subject to change based on the Reserve Bank of India’s monetary policy and the overall economic environment. Hence, it is wise for investors to check the prevailing rates at the time of booking.

Senior Citizen Benefits

For senior citizens, IndusInd Bank offers an extra layer of advantage. They usually receive an additional 0.50% interest over the standard rates, which significantly boosts their overall returns. This small difference compounds effectively, especially for longer tenures. It also serves as a safe and stable source of income for retirees who rely on regular interest payouts.

Many senior citizens prefer monthly or quarterly interest payout options instead of reinvestment plans, allowing them to manage their living expenses without touching the principal amount. IndusInd Bank provides this flexibility, making it a dependable choice for post-retirement financial security.

Tenure And Flexibility

One of the key strengths of IndusInd Bank’s fixed deposits lies in the flexibility of tenure selection. Customers can choose from short-term deposits starting at 7 days or opt for long-term deposits stretching up to 10 years. This wide range allows individuals to plan their investments according to their liquidity needs and financial goals.

The bank also offers different interest payout options such as monthly, quarterly, half-yearly, or at maturity. Such choices allow depositors to align their returns with specific financial requirements, whether it is funding education, vacations, or long-term wealth accumulation.

Tax And TDS Impact

Like most banks, the interest earned on IndusInd Bank FDs is taxable under the Income Tax Act. The bank deducts TDS (Tax Deducted at Source) if the total interest earned in a financial year exceeds the prescribed limit. However, individuals can submit Form 15G or Form 15H to avoid TDS deduction, provided they meet the eligibility criteria.

For those looking to save on taxes, the bank also offers tax-saving fixed deposits under Section 80C of the Income Tax Act. These have a mandatory lock-in period of five years, but the benefit is that the invested amount, up to a certain limit, qualifies for a deduction from taxable income.

Premature Withdrawal Rules

While fixed deposits are designed to stay locked until maturity, IndusInd Bank does allow premature withdrawals. However, such withdrawals come with penalties that slightly reduce the interest earned. This feature ensures liquidity for emergencies while maintaining discipline among investors to hold their funds for the intended period.

Alternatively, investors who want flexibility without breaking their deposits can use overdraft facilities against their FDs. This enables them to borrow money without losing out on the interest benefits of the deposit.

Online And Mobile Access

Digital convenience is another major advantage with IndusInd Bank. Customers can easily open, renew, or close fixed deposits through the IndusInd Bank mobile app or internet banking portal. The process is seamless and requires only a few clicks, eliminating the need to visit a branch physically.

Additionally, customers can track their FD maturity dates, calculate interest, and even choose auto-renewal options through digital platforms. This modern approach to a traditional product adds both efficiency and accessibility, appealing to the tech-savvy generation.

Smart Investment Strategy

To make the most of IndusInd Bank’s FD offerings, investors can use a laddering strategy. This means spreading their investment across multiple tenures rather than locking it all into one. For example, an investor can split the amount into one-year, two-year, and three-year FDs. This approach ensures steady liquidity while capturing the benefit of changing interest rates over time.

Reinvesting the maturity amount at revised rates can also help maximize returns in a rising interest rate environment. This strategic planning transforms a simple FD investment into a smart, growth-oriented financial tool.

Why Choose IndusInd

IndusInd Bank stands out for its customer-centric approach, strong digital ecosystem, and competitive rates. The trust and transparency it offers give investors peace of mind, especially when securing long-term savings. In an era of unpredictable market movements, such stability is invaluable.

Whether you are saving for future expenses, building an emergency fund, or seeking guaranteed growth, IndusInd Bank’s FD schemes provide a balanced solution. The combination of flexibility, attractive returns, and reliability makes it a compelling option for both new and seasoned investors.

Final Thoughts

The IndusInd Bank Fixed Deposit in 2025 represents a perfect blend of security and profitability. With interest rates touching up to 8.25%, it stands as one of the most rewarding avenues for low-risk investors. Its diverse tenure options, senior citizen perks, and digital convenience enhance the overall experience.

For anyone aiming to grow their savings steadily without market uncertainty, an IndusInd Bank FD can serve as a cornerstone of financial planning. As always, evaluating your investment horizon, tax implications, and liquidity needs will help you make the most of this opportunity.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making investment decisions. Rates and terms are subject to change.