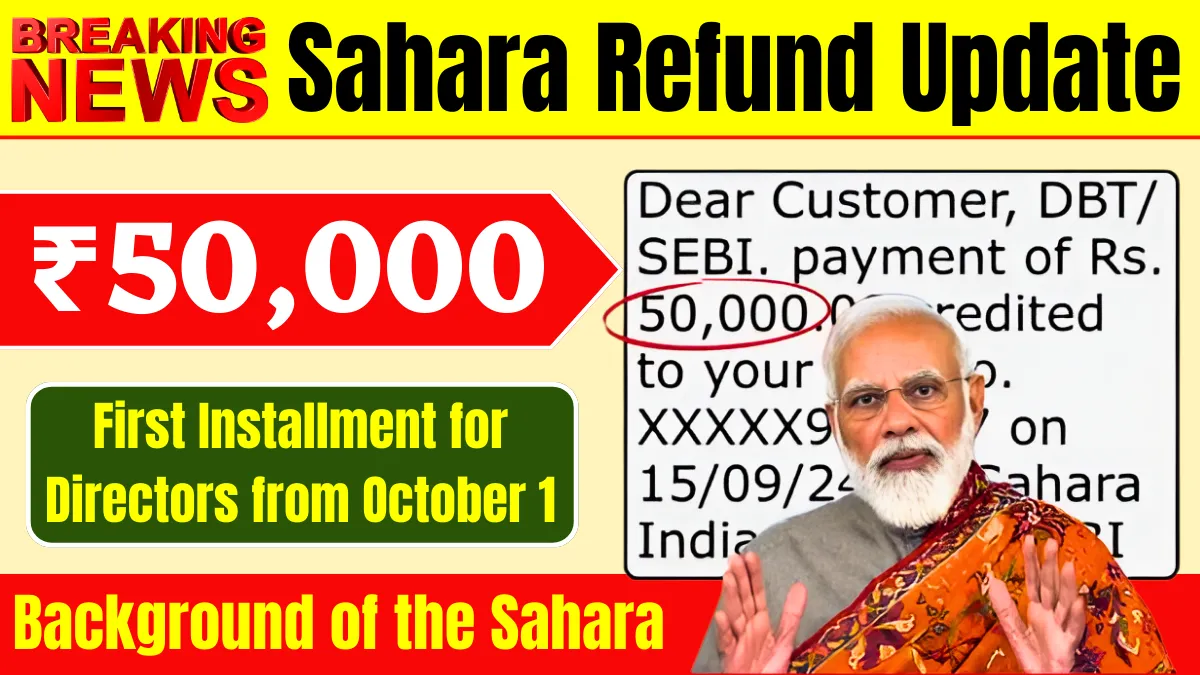

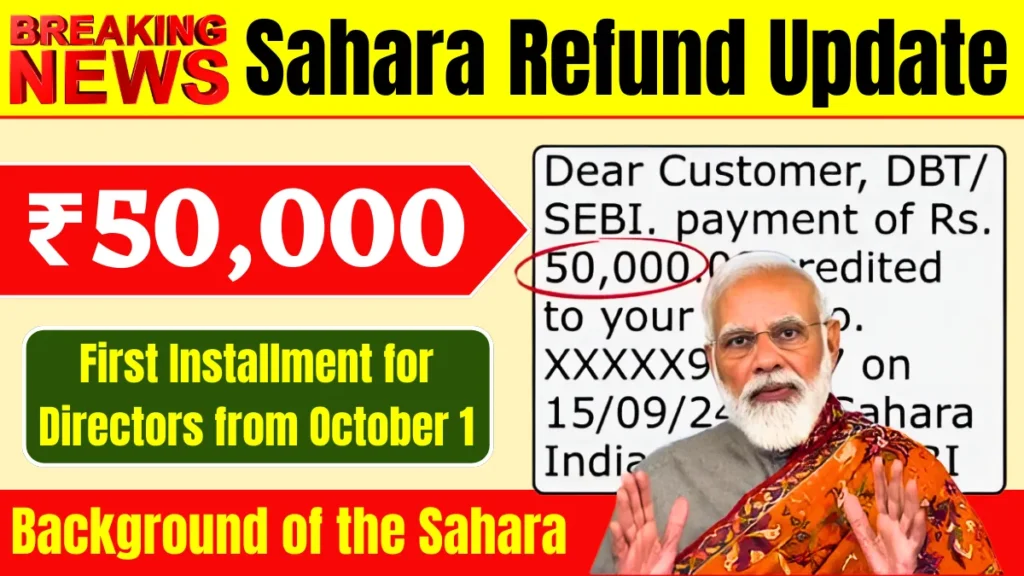

The long-awaited Sahara refund saga has taken a significant turn in 2025, bringing relief to many investors who have been waiting for years to receive their dues. As per the latest update, the Securities and Exchange Board of India (SEBI) and the Supreme Court have approved the disbursal of the first installment of ₹50,000 to Sahara directors, starting October 1, 2025. This announcement marks a critical milestone in the decades-long battle for justice and financial recovery.

The Sahara group, once one of India’s largest conglomerates, became embroiled in one of the country’s most high-profile financial controversies. The case began in 2010 when SEBI accused Sahara of raising over ₹24,000 crore through optionally fully convertible debentures (OFCDs) without proper regulatory approvals. After years of legal wrangling and court interventions, the Supreme Court ordered Sahara to refund the money to investors. However, the process has been slow, leading to frustration and uncertainty among investors.

The news about the first installment coming in October 2025 brings hope and clarity to thousands of individuals who invested in Sahara’s schemes. The refund will be made directly to the accounts of the investors, with the directors receiving the initial payment as a part of the ongoing disbursal process. The amount of ₹50,000 is only the beginning, with further installments planned to be released in the coming months and years.

Background of the Sahara Case

To fully understand the significance of this refund update, it is important to revisit the background of the Sahara case. Sahara India Pariwar, led by Subrata Roy, was a sprawling conglomerate with interests ranging from real estate to media. The company attracted millions of investors through its OFCD schemes, promising attractive returns. However, SEBI found that these securities were not registered as per legal norms, and investors had been misled.

In 2012, the Supreme Court took cognizance of the matter and ordered Sahara to refund the money collected illegally. Despite several extensions and legal battles, Sahara faced immense pressure to comply with the court’s order. The company was asked to deposit around ₹15,000 crore into a designated escrow account to facilitate the refund process. Subrata Roy was even held in custody for a period for failing to cooperate.

The process of refunding investors has been painstakingly slow, owing to the sheer volume of investors involved and the complexities of verifying legitimate claims. Many investors had lost hope, with some selling their claims to third parties at discounted rates. The announcement of the ₹50,000 first installment is, therefore, a significant development in restoring investor confidence.

What the Refund Means for Investors and Directors

The immediate impact of the refund installment will be felt most strongly by the investors and directors associated with the Sahara group. For investors who have been waiting over a decade to recover their money, the payment is not just a financial relief but a restoration of faith in the justice system. Many small investors had put their life savings into Sahara schemes, hoping for steady returns, and the refund will alleviate some of their financial burdens.

Directors receiving the first installment indicates that the process is being rolled out systematically. While the ₹50,000 is just the initial part of a larger refund amount, it sets the pace for future payments. The directors, who played key roles in managing Sahara’s affairs, are expected to be fully refunded over the next few years as the disbursal continues.

The refund also signals to the wider investment community the importance of regulatory compliance and investor protection. Sahara’s saga serves as a cautionary tale, emphasizing that legal and regulatory bodies are committed to safeguarding investors’ interests, even if it takes years to enforce justice.

Challenges in the Refund Process

While the announcement is welcome news, the Sahara refund process is not without its challenges. One of the main issues has been the identification and verification of genuine investors. Given the massive scale of the scheme, with millions of investors spread across the country, verifying each claim has been a mammoth task.

Many investors did not maintain proper documentation or contact details, making it difficult for authorities to trace them. Additionally, some investors sold their claims in the secondary market, further complicating the process of rightful ownership. This verification exercise has delayed the refund process multiple times in the past.

Moreover, the Sahara group has faced liquidity constraints, impacting its ability to make timely payments. The freezing of assets and ongoing legal proceedings have limited the funds available for immediate disbursal. This is why the refund has been structured as multiple installments rather than a lump sum.

Despite these hurdles, the SEBI and the Supreme Court have been persistent in ensuring that investors receive their money. The government and regulatory agencies are also working on creating awareness and simplifying the refund claim process to expedite future payments.

What Investors Should Do Next

For investors who had invested in Sahara’s OFCD schemes, it is essential to stay updated with official communications from SEBI and the refund authorities. Many investors may receive direct notifications via SMS or email about their refund status and payment schedules.

Investors are advised to keep their bank details and identification documents ready to ensure a smooth transfer of funds. It is also important to beware of fraudulent schemes or individuals posing as Sahara officials to extract money or personal information.

Those who have not yet registered their claims or verified their investment details should do so promptly through the official refund portal or designated channels. Timely action can help avoid delays in receiving the installments.

For directors and other stakeholders, maintaining transparent communication and cooperation with regulatory authorities is crucial. Their role in facilitating the refund process will be closely monitored, given the legal and financial implications.

The Broader Impact on India’s Financial Sector

The Sahara refund update is not just about one company or its investors. It reflects a broader evolution in India’s financial regulatory environment. The case has strengthened SEBI’s position as a vigilant watchdog and sent a clear message to other companies about the consequences of regulatory violations.

Investor protection mechanisms are being continually enhanced, and the government is focused on creating a more transparent and accountable financial ecosystem. The introduction of stricter norms for raising funds from the public and better grievance redressal frameworks are direct outcomes influenced by cases like Sahara.

Furthermore, the refund process highlights the increasing use of technology in handling large-scale financial disputes. From digital KYC (Know Your Customer) processes to online payment disbursals, technology is playing a pivotal role in ensuring efficiency and transparency.

Looking Ahead: What the Future Holds

As the Sahara refund disbursal begins in earnest with the ₹50,000 first installment for directors starting October 1, 2025, stakeholders are hopeful that the process will gain momentum. Future installments are expected to continue at regular intervals, ensuring that investors eventually recover the bulk of their invested amounts.

The case remains a landmark example of regulatory enforcement and judicial intervention working hand-in-hand to protect public interest. While the journey has been long and fraught with obstacles, the progress made in 2025 rekindles optimism.

Investors, directors, and financial market participants will be watching closely to see how the subsequent phases of the refund unfold. It is expected that the lessons learned from Sahara will help shape better policies and practices, reducing the chances of similar controversies in the future.

In conclusion, the announcement of the ₹50,000 first installment refund starting October 1 is a pivotal moment in the Sahara refund saga. It symbolizes justice served after years of struggle and underlines the importance of regulatory oversight in maintaining trust in India’s financial markets. For investors and directors alike, it is a step toward closure and financial recovery.

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute financial advice. Readers should verify all details independently and consult with a qualified financial advisor before making any investment or legal decisions related to the Sahara refund process.